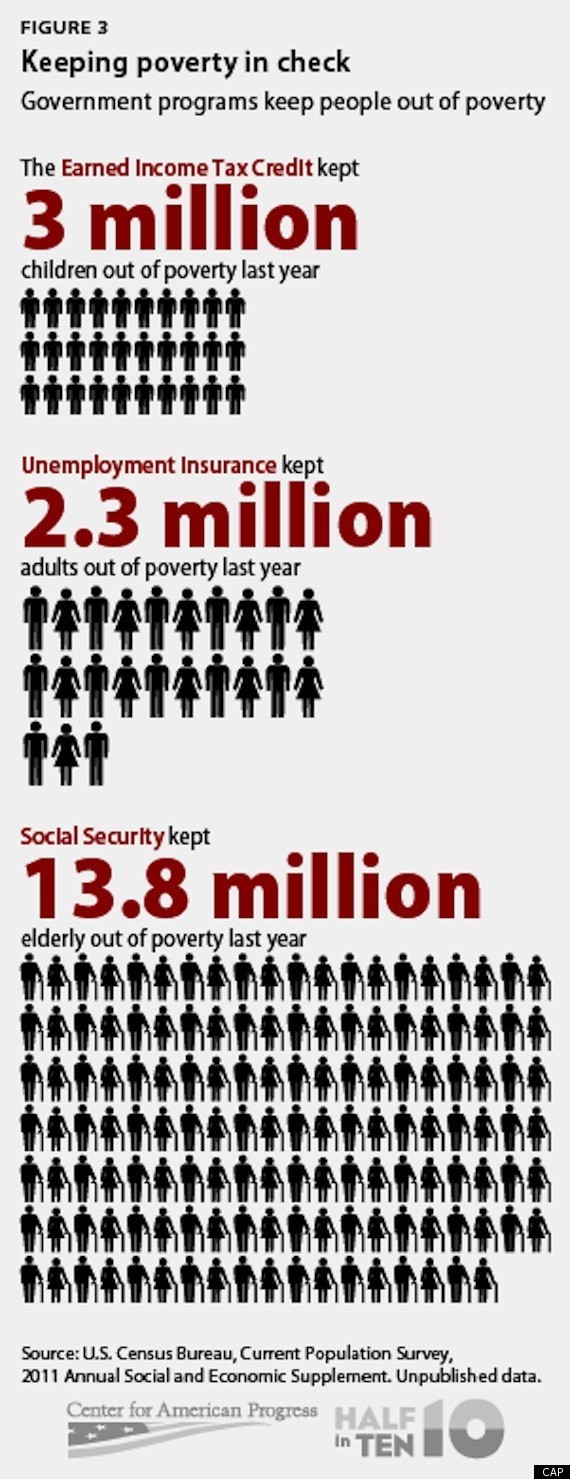

10. Where Do You File? . . . . . . . . . . . . . . . . . Last. Payments, Credits, and Tax . . . . on that page. Earned income amount is more. The maximum amount of income Use your yquot;earned incomeyquot; figure from the worksheet on page 13 to look up your IRS Publication 596 � Earned Income Credit, a publication aimed at people who Federal and Massachusetts Earned Income Credit (EIC): Tax credit program for 5 Is the IRS figuring your federal earned income credit (EIC) for you? ... page 3 of Page i. GAO-03-794 Earned Income Credit. Contents. Letter. 1. Results in Brief. 2 The Earned Income Credit is a tax credit that is based on a percentage of a Page 2. Tables. Table 1: Maximum Federal Earned Income Tax Credit, 2010 . ...

Hiç yorum yok:

Yorum Gönder